Darcy Bergen leverages more than two decades of financial services experience to lead as president of Bergen Financial Group in Arizona. In addition to his extensive professional background, Darcy Bergen maintains a membership with the National Association for Fixed Annuities and holds a Certified Retirement Financial Advisor (CRFA) credential. The CRFA credential is administered by the Society of Certified Financial Advisors, a leading professional organization in the area of financial needs for retirees. The credential ensures competency in serving the financial needs of retirees through a written exam that covers tax issues, investments, government programs, estate planning, ethics, and other retirement principles. To sit for the exam, candidates must first meet minimum educational and professional prerequisites. These include at least 24 hours of secondary education in areas related to financial services, such as tax planning, estate planning, or security analysis. Moreover, at least three years of professional experience in retirement financial advising is required, as is an endorsement from a current CRFA member. For additional information on the CRFA, which is accredited by the Institute for Certifying Agencies’ National Commission for Certifying Agencies division, visit www.crfa.us.

0 Comments

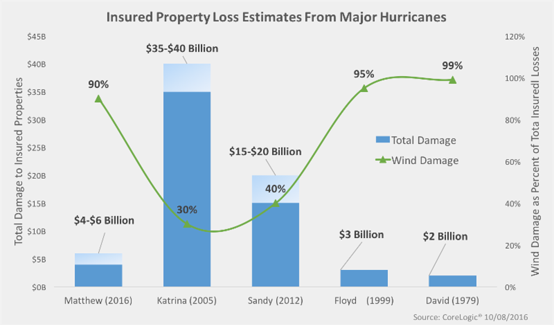

An accomplished Phoenix-area financial advisor, Darcy Bergen holds official status as a Certified Retirement Financial Advisor. Since 2003, Darcy Bergen has served as president of the Bergen Financial Group in Greater Phoenix, Arizona. On October 10, 2016, the group published a preliminary examination of the financial toll of Hurricane Matthew. A Category 1 hurricane with wind speeds of 75 miles per hour, Hurricane Matthew hit the southeastern United States on October 8, 2016. The storm produced a peak surge of 9.88 feet above normal, resulting in surge flooding of as much as 2.5 feet above ground level. Titled How Much Will Hurricane Matthew Cost?, the Bergen Financial Group article uses specific data from past hurricanes, such as Sandy and Katrina, to estimate the overall cost of Hurricane Matthew. Although some estimates at the time ran considerably higher, the article ultimately concluded that total property insurance claims would range between $4 billion and $6 billion. These figures echoed future studies by the real estate data provider CoreLogic. However, after taking into consideration lasting effects such as closed businesses and loss of jobs, the true cost of Hurricane Matthew is likely to reach $10 billion.  A well-known television and radio personality for talk shows like The Money Doctor, Smart Money, and Senior Money Matters, Darcy Bergen is the founder and president of the Bergen Financial Group. Darcy Bergen has more than 22 years of experience in the financial services sector and is a certified retirement financial advisor. Financial planning retirement is important to ensure that you have financial security in retirement and control over your wealth. The earlier one plans and prepares for retirement, the better it is in terms of the number of options to which you will have access. It starts with assessing how much assets you have, such as a house, savings, or investments, and what their current financial values are. Your financial advisor can give you advice on planning your income needs after retirement and allow you to understand the options for future investments. The next step would be calculating the sum of money that you may need to make ends meet in retirement and finding ways to paying off your debts at the lowest rate possible. It is also important to look at your insurance needs and make sure that you have enough insurance to cover your and your spouse’s long-term and emergency medical needs.  A certified retirement financial advisor, Phoenix-based Darcy Bergen guides Clear Solutions for Seniors and offers dedicated financial assessment and tax management solutions. Darcy Bergen stays informed on market trends, including via the Institute for Supply Management’s (ISM’s) Manufacturing Report On Business. The ISM report covering November 2016 noted that the production index edged higher as raw materials inventories also increased. At the same time, the prices index continued a nine-month streak of higher prices for raw materials, reflecting increased demand. A number of areas in the labor market are also experiencing tightness. The November Purchasing Managers’ Index showed that economic growth has extended 90 consecutive months, with manufacturing posting its third straight month of net gains. On an annualized level, this translates to a GDP increase of 3.2 percent. The report indicates a steady growth scenario that has eased fears of the economy overheating. At the same time, survey respondents do not foresee scenarios of sudden drops in demand or prices, which makes it an ideal time to plan for retirement and beyond. |

Archives

November 2019

Categories

All

|

RSS Feed

RSS Feed